To Hike or not to Hike? Now that is the question.

Economists are at odds over whether the Reserve Bank of Australia should suspend rate hikes in April or raise the cash rate by another 25bps, as the RBA confronts how to bring inflation down with higher interest rates while not sending the economy into recession. The bond market is indicating rate increases are over… but inflation remains uncomfortably high. Will the RBA hike again?

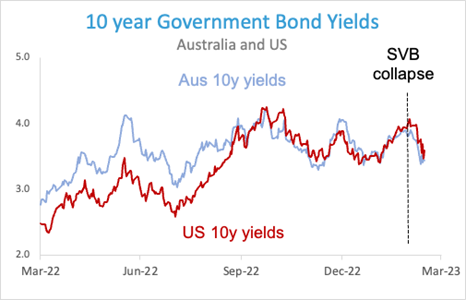

The collapse of several US regional banks and the global bank Credit Suisse has dramatically affected the market’s expectations for future interest rate moves. The bond market indicates that the aggressive tightening campaign by global central banks is over amid growing concerns that the contagion sparked by Silicon Valley Bank’s collapse will end in a global recession. Markets worldwide have fallen, with banks stocks being particularly hard hit.

In early March RBA governor Philip Lowe confirmed that the central bank was closer to a pause and said that the board would be carefully assessing the monthly employment and business indicators, which have now been released, along with retail trade figures and the monthly consumer price index (CPI) indicator. And this was before the recent global banking crisis.

Reading bond yield tea leaves – have we seen the end of higher rates?

Market watchers see yields on bonds as an indicator of future interest rates[1]. After the collapse of the Silicon Valley Bank, the Australian three-year bond yield plunged from 3.4% per cent down to under 3% - this is a dramatic move in the bond world. Given that the official cash rate is currently 3.6 per cent, it would appear traders have eliminated any further tightening by the RBA from their rates profile, and in fact, they have started to factor in a small risk of a rate cut later this year.

This follows a similar pattern in the US, where the yield on the two-year US Treasury bond, which is sensitive to interest rate expectations, plunged more than half a percentage point on March 13th, posting the biggest three-day fall since the Black Monday crash of October 1987. Reading yield curve tea leaves, traders are now expecting around 0.75 percentage points of Federal Reserve rate cuts implied by year-end.

But yield curves are not only a reflection of interest rates – the yield on bonds is driven by supply and demand dynamics, which take into account estimates of future economic activity, that includes a collective view of future cash rates but also encompasses views on national productivity, unemployment and inflation.

Importantly, bonds are also seen as a safe haven asset. Some see the collapse of Credit Suisse and the US banks as a precursor to a global recession, and this is where the flight to safety comes in, driving a greater demand for bonds, which pushes yields lower.

Inflation is easing – but not fast enough

Despite the large and sudden drop in bond yields, the Federal Reserve in the US pressed ahead with another 25 bps at their most recent meeting on March 22nd, setting a new target range of 4.75% to 5%, the highest level since 2007. While most economists predicted this latest rate rise by the Fed, it still surprised many. US inflation eased in February but remained stubbornly high, presenting a challenge for the Federal Reserve as it confronts how to slow the economy with higher interest rates while not sending it into recession.

The RBA now face the same challenge - have they done enough to slow the economy and bring inflation back down to their target band or 2% - 3% or do they need to keep raising rates and risk sending the economy into recession.

So will the RBA keep raising rates or are we done for this cycle?

But while inflation is slowing both here and in the US, it isn’t going away as quickly as many may have hoped. Federal Reserve officials have continued to beat the drum on their aggressive inflation fight, saying the central bank will keep hiking interest rates until it’s under control.

The issues are the same for Reserve Bank of Australia. Market pricing for RBA’s terminal rate has moved considerably. But the solid underlying momentum in the economy, as evidenced by the robust business conditions and stable labour market, suggests further tightening may be needed.

The RBA may indeed pause rate rises at its April meeting, or it may follow the US with another 25bps increase. We will find out on April 4th at 2:30pm (AEST). While another hike will be hard for those with mortgages and continue to put pressure on the housing market, the cost of living will only reduce as inflation comes down to the RBA’s target band.

The positive news for investors is that inflation is moving in the right direction, and we expect that interest rates are now very close to their “terminal rate” for this cycle.

[1] Yields and prices are inversely related, so falling yields on bonds means that bond prices are increasing, and rising yields means that bond prices are falling.

General Advice Warning

Any advice or information in this publication is of a general nature only and has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your personal objectives, financial situation and needs.

Before making a decision to acquire a financial product, you should obtain and read the Product Disclosure Statement (PDS) relating to that product, it is important for you to consider these matters and to seek appropriate advice. Past performance is not a reliable guide to future returns. The information in this document reflects our understanding of existing legislation, proposed legislation, rulings etc as at the date of issue. In some cases, the information has been provided to us by third parties. While it is believed the information is accurate and reliable, this is not guaranteed in any way. Opinions constitute our judgement at the time of issue and are subject to change. Neither we nor our employees give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document.

Identity McIntyre Pty Ltd (ASIC No 461171) is a corporate authorised representative of IMFG Pty Limited, Australian Financial Services Licensee number 527657 Registered Office at: Level 8, 171 Clarence Street, Sydney NSW 2000.