2023 - The year that was...

It’s not quite the end of 2023 yet, but with data to November 30 it’s close enough to review the performance of the Australian and global equity markets and the global bond market. We are not expecting any big changes as we come into the final weeks of the year, but of course the unexpected could always happen!

Before reviewing the performance of markets this year, it’s always a good idea to do this in context of what happened last year. The threat of rising interest rates against a background of soaring inflation pushed stocks down in the first months of 2022, and coupled with the conflict in Ukraine and the start of the aggressive interest rate cycle that began in May the market remained volatile throughout the year.

In Australia the ASX 200 index reached its lowest point at the end of September and was down negative 9.6 percent. The last quarter saw a recovery, and the index finished 2022 down negative 1.1 percent. But that was relatively good compared to the rest of the world – in the US the S&P 500 index was down by more than 20 percent at times – what’s termed a bear market – and finished the year down negative 18.5 percent. The high tech stocks did even worse – they ended the year down by negative 32.5 percent.

And as interest rates rose from essentially zero to end 2022 at 3.1 percent after 8 consecutive rate rises the bond market delivered its worst returns on record, with the Australian bond market down near negative 10 percent and the global bond market coming in at negative 12.3 percent.

What were the predictions this time last year? Given that central banks had more work to do to bring inflation back to their target 2 – 3 percent band, the general view was that Australia and the global economy were heading for an unavoidable recession. It was going to be another tough year for equities, and particularly for high-tech stocks – which in theory are more interest rate sensitive than other sectors. But bond managers were very bullish on fixed interest, with commentary that bonds were about to make an historic recovery in the face of the economic slowdown.

So how has 2023 played out?

Australian Equities

In fact 2023 kicked off with a bang for the ASX with one of the strongest January returns on record. Why? Well no-one really knows, but at the time commentators were saying that the market had reassessed the effect of interest rate rises and concluded it's not going to be as bad as they thought back in December.

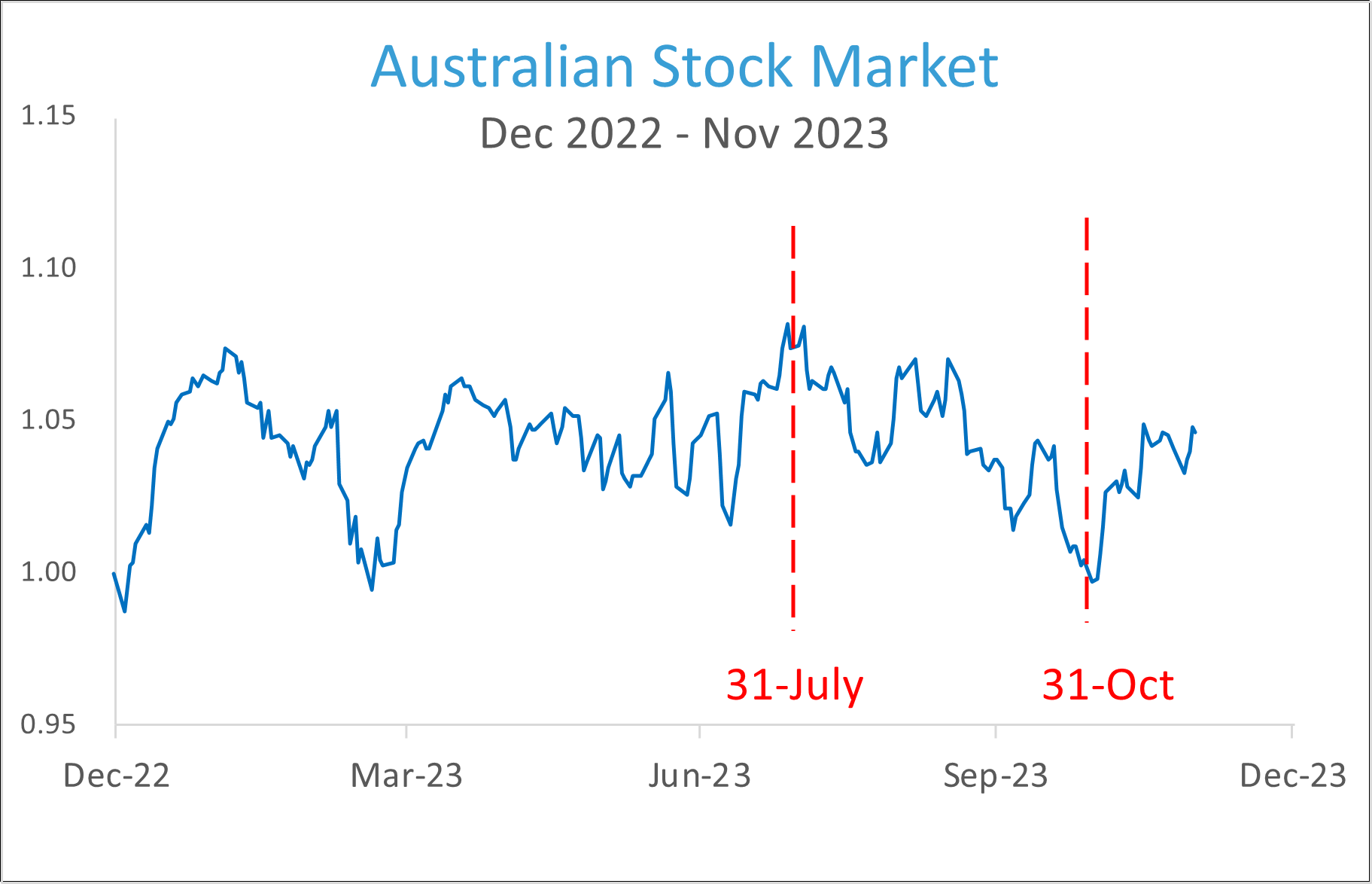

The market did fall over in early March when several US regional banks got into trouble and collapsed, and regulators had to step in to rescue the depositors. This reverberated across the global banking system, and in Europe Credit Suisse was sold to fellow Swiss banking giant UBS. But the banking “crisis” passes swiftly, and from there the market continued to rally – despite the continuing rate increases from the RBA – reaching a peak of 7.5 percent at the end of July, as shown in the chart below.

It was about that time that both here in Australia and the Federal Reserve Bank in the US reiterated that they expected interest rates will not be coming down anytime soon – rates would stay “higher for longer”. This became a mantra for quite a few weeks, wiping out the gains for the year and by the end of October was sitting on a year to date return of zero.

But from early November the market has been unexpectantly going up. it's what some people call a Santa Rally, which is not uncommon in that markets finish the year with a sense of optimism. In this case the Santa Rally has been driven by the sudden fall in bond yields, indicating that interest rates will start coming down sooner than expected. By the end of November the ASX 200 had returned a positive 4.8 percent year to date.

Global Equities

In fact festive cheer has come early to world markets on growing certainty that central banks will start slashing interest rates next year. Global stocks posted their best monthly performance in three years in November and global investment-grade bonds returned almost 4% - the best month on record going back to 1997.

While major markets were beaten down in 2022 it's the exact reverse in 2023 - even though interest rates have continued to go up. As mentioned, this is meant to be bad for high-tech stocks (at least that's what we were told way back in January) but the high-tech Nasdaq index has returned a staggering 37 percent this year, as shown in the chart below.

The Benefits of Diversification

Of more interest to an Australian investor is how these returns from other markets have played out in a diversified portfolio. While Australia has returned 4.8 percent developed markets (represented by the MSCI World ex Australia Index) has retuned an impressive 21%, while the Emerging Markets (represented by the MSCI Emerging Market Index) are up just over 8 percent for the year.

Depending on the mix of Australian to global shares a diversified portfolio has had an excellent year, returning anywhere between 12 to 14 percent – much greater than the average of around 8% over the last 20 years.

Global Bonds

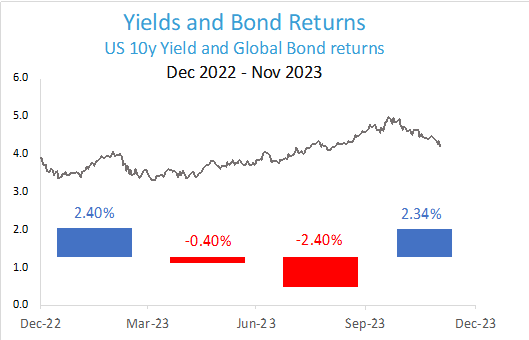

The global bond market had the worst year on record in 2022, and while no one expected bonds to fully recover that drawdown there was hope they would make a lot of ground back. And in the first quarter bonds certainly made a good start, thanks to those US Banks that fell over. Investors believed that this was the start of the recession we had to have – to borrow a famous saying – and there was a flight to the safety of bonds. The good news here was that bonds performed their traditional duty of providing a safety net when equities fall.

However, the banking “crisis” was short lived and soon interest rates – and yields – continued their march upward. The chart below shows the yield of the Australian 10 year Government bond throughout the year, superimposed on the quarterly returns of the global bond market (as represented by the Bloomberg Global Aggregate Bond index hedged to Australian dollars). As yields go up, bond prices go down.

New Paragraph

It was a miserable second quarter and a really bad third quarter for the bond market, and in fact by around October those bond yields were hitting heights not seen for 15 years or so. It was looking very grim on the bond side and then everything changed. Instead of “higher for longer” the new mantra was “the pivot is near” - the Federal Reserve in the US had not only finished with rate hikes but were going to start cutting interest rates as early 2024.

By the end of November there is an overall positive return for bonds. The Australian bond market has returned 2.5 percent, with the global bond market right behind on 2.4 percent. While these returns are not quite as good as cash, it does show that bonds are on the way back.

2023: The Year That Was

We can sum up 2023 by saying that while Australia had a modest return of 4.8% (to November 30) international markets had an outstanding year lifted by the high-tech stocks in the US. A diversified portfolio of Australian, developed, and emerging shares had a return of around 13 percent, 5 percentage points higher than the average return for the last 20 years. And the bond market is now returning to a state of normality, with positive returns, good income, and the ability to take its traditional role as a safety net when equity markets have sudden downturns.

I hope you all enjoy the holiday season and all the best for a great new year in 2024.

Dr Steve Garth

Independent Member of IMFG Investment Committee

December 12, 2023

General Advice Warning

Any advice or information in this publication is of a general nature only and has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your personal objectives, financial situation and needs.

Before making a decision to acquire a financial product, you should obtain and read the Product Disclosure Statement (PDS) relating to that product, it is important for you to consider these matters and to seek appropriate advice. Past performance is not a reliable guide to future returns. The information in this document reflects our understanding of existing legislation, proposed legislation, rulings etc as at the date of issue. In some cases, the information has been provided to us by third parties. While it is believed the information is accurate and reliable, this is not guaranteed in any way. Opinions constitute our judgement at the time of issue and are subject to change. Neither we nor our employees give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document.

Identity McIntyre Pty Ltd (ASIC No 461171) is a corporate authorised representative of IMFG Pty Limited, Australian Financial Services Licensee number 527657 Registered Office at: Level 8, 171 Clarence Street, Sydney NSW 2000.