Gravity catches up with big tech.

In the Roadrunner cartoons, Wile E. Coyote would chase his nemesis relentlessly, even running off cliffs and continuing running into mid-air. Only when he looked down and realised there was no longer any support did he fall.

This gives rise to the term “a Wile E. Coyote moment” in financial markets.

When investors realise the stock market has been running without support for a long time, and prices that should have long since been gradually coming down suddenly collapse.

Coyotes can defy gravity for years in the markets — but generally, there comes the point when gravity catches up to them. This year has seen the large tech stocks having to readjust to a world where persistent inflation has forced central banks to push up interest rates, thus ending the years of cheap money and the ability to defy gravity.

The large tech stocks are now known by the acronym FAANGs, which represents Facebook, Apple, Amazon, Netflix and Google. But the acronym generally applies to large tech stocks, such as Microsoft[1]. A combination of rising interest rates, market saturation, increasing competition and a reset in tech stock valuations has changed the narrative for FAANG in 2022.

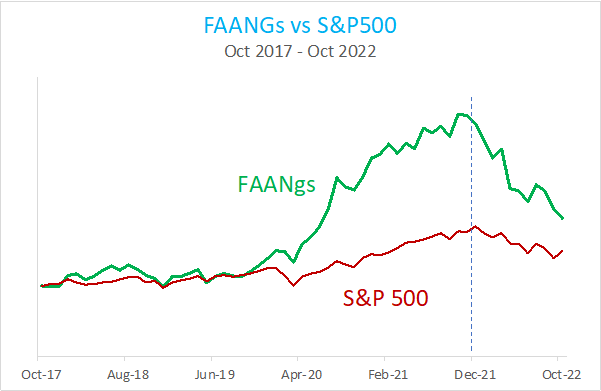

The chart below shows the FAANG index's extraordinary performance[2] relative to the broader US market (represented by the S&P 500 index) over the last five years.

Microsoft, Google-owner Alphabet and even Apple have all suffered write-downs to varying degrees this year, but the fall from the sky of Meta Platforms Inc., the Facebook parent, and Amazon has been particularly hard.

Meta has underperformed the S&P 500 since it went public in 2012. For investors who thought they were betting on the next big thing, it won’t be surprising if they start to think twice.

Unfortunately for the tech sector, the bad news continues with Amazon.com Inc. Its third-quarter earnings released at the end of October were in line with market expectations. Still, shares plummeted 13% when the company issued a disappointing fourth-quarter forecast. It’s the second time this year Amazon’s results have been disappointing enough to spark a double-digit percentage sell-off. In April, a weak forecast for the second quarter led to a 14% drop in the stock.

Like the rest of Big Tech, Amazon has had a rocky year as it confronts macroeconomic headwinds, soaring inflation and rising interest rates. Those challenges have coincided with a slowdown in Amazon’s core retail business as consumers returned to shopping in stores. Amazon has been down as much as 40% this year.

As the chart above shows, FAANG stocks were doing better than the market even before the Covid-19 sell-off in March 2020. Investors worked on the assumption that these companies would benefit from the pandemic, which they unquestionably did — but it is only now that investors have fully grasped that they shouldn’t be valued as though the pandemic conditions would continue forever. Remarkably, if you measure relative performance between the FAANG+ index and the broader S&P 500 index from March 2020, then the indices are now level pegging.

The sell-off in the “new economy” tech sector has seen a rotation into the “old economy” stocks, which tend to have more stable earnings streams and typically are less sensitive to interest rate increases. High-growth tech names are more sensitive to rising interest rates as, typically, they are valued based on their projected profits far into the future. As the US Federal Reserve continues with its aggressive tightening monetary policy, the future profits of tech firms will be worth far less.

This is not to imply that there is anything wrong with these companies, and they will continue to deliver products and services that are sought after by consumers. But their valuations are at last being examined critically.

The takeout for an investor is that trying to time the “next great thing” in the stock market is a difficult game to play. Which company will turn out to be the best investment? What sector will be the strongest performer? Which country will offer the highest return? The truth is nobody knows.

Fortunately, you don’t need to rely on guesswork to invest well. It turns out that for long-term investors, a diversified approach that includes all segments of the market – both domestic and international – is a great way to increase your opportunity set, manage overall risk and improve the reliability of outcomes.

This article was inspired by Wile E. Coyote Moment as Tech Goes Off the Cliff by Bloomberg Opinion columnist John Authers. Economist and New York Times editorial writer Paul Krugman is usually credited with making the connection between Wile E. Coyote with economic disaster in 2003.

[1] FAANG lost its “G” in 2015 and its “F” in 2021 when Google and Facebook rebranded themselves as Alphabet and Meta Platforms, respectively. Netflix has been hit particularly hard, and the company has dropped behind its peers in terms of growth and prominence. So after booting Netflix from FAANG, replacing it with Microsoft and adjusting for the corporate name changes, we now have a new acronym: MAMAA—for Meta, Amazon, Microsoft, Apple and Alphabet

[1] We use the FANG+ Index, which has ticker code NYFANG, to plot the performance of these large tech stocks. The NYSE FANG+ Index provides exposure to 10 tech giants – Apple, Amazon, Netflix, Alphabet (Google), Microsoft, Alibaba, Nvidia, Baidu, Tesla and Meta (Facebook).

General Advice Warning

Any advice or information in this publication is of a general nature only and has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your personal objectives, financial situation and needs.

Before making a decision to acquire a financial product, you should obtain and read the Product Disclosure Statement (PDS) relating to that product, it is important for you to consider these matters and to seek appropriate advice. Past performance is not a reliable guide to future returns. The information in this document reflects our understanding of existing legislation, proposed legislation, rulings etc as at the date of issue. In some cases, the information has been provided to us by third parties. While it is believed the information is accurate and reliable, this is not guaranteed in any way. Opinions constitute our judgement at the time of issue and are subject to change. Neither we nor our employees give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document.

Identity McIntyre Pty Ltd (ASIC No 461171) is a corporate authorised representative of IMFG Pty Limited, Australian Financial Services Licensee number 527657 Registered Office at: Level 8, 171 Clarence Street, Sydney NSW 2000.